Bitcoin’s open interest in futures markets recently reached an all-time high amid the latest market upsurge that has seen the asset claim new price peaks. The Bitcoin (BTC) OI has spiked to $55.7 billion, indicating a massive increase in trading…

In the midst of the most recent market rise that has seen the commodity reach new price peaks, open interest in Bitcoin futures markets just hit an all-time high.

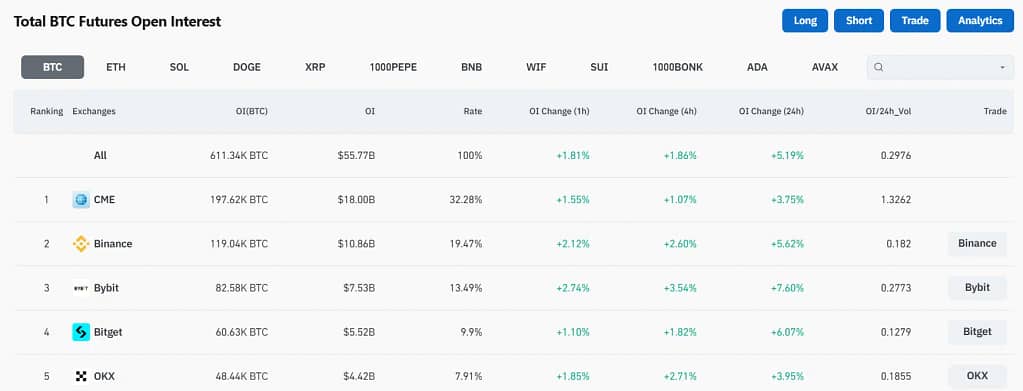

The data aggregator Coinglass reports that the Bitcoin OI has risen to $55.7 billion, a significant increase in trading activity and investor interest (BTC 4.78%). This most recent increase comes after a prior decline to $26.65 billion on August 6.

The majority of this amount is held by CME, which has 197,620 BTC, or $18 billion, or around 32.3% of the whole Bitcoin futures OI.

With an open interest of over 119,000 BTC, or over $10.86 billion, Binance, the biggest cryptocurrency exchange by trading volume, comes in second with 19.47% of the total OI.

With 13.49% of the open interest, Bybit comes in third place with 82,580 BTC, or $7.53 billion. Bitget and OKX complete the top five with around 9.9% and 7.91% of the market share, respectively.

Following a positive price spike that started around the Nov. 5 U.S. presidential election, OI has recently recovered. Bitcoin soared, breaking previous milestones as the market responded to Donald Trump’s election triumph.

Yesterday, the cryptocurrency had a temporary decline after briefly hitting a new all-time high of $93,480. As of this writing, Bitcoin is trading at $91,108, up 4% over the previous day.

Bitcoin encounters opposition

In order to maintain its upward trajectory, Bitcoin must overcome the resistance that is now present around the $91,265 level, which is close to its upper Bollinger Band.

The Commodity Channel Index just peaked at 247 during the increase, indicating that the asset is overbought. Despite the fact that the CCI has now retraced to 163.35, the price of Bitcoin and this indicator seem to be at odds.

Notably, during the last three days, the flagship cryptocurrency has continued to rise to new heights, but during this time, its CCI has decreased. A possible slowdown may be suggested by the discrepancy between the CCI decline and Bitcoin’s recent highs.

A decline might be on the horizon if Bitcoin is unable to overcome the present barrier. In such case, $88,000 is the closest support, and if the downturn persists, there is additional stability at $87,113 and $83,258.

However, a successful breach of the $91,265 barrier might cause Bitcoin to retest its recent ATH over $93,000, and the strong OI would indicate that investors are still hopeful.

Due to the unregistered JENNER meme currency, Caitlyn Jenner is being sued.

Caitlyn Jenner, a former Olympian, was sued in class action by JENNER customers for failing to register the token with the SEC and for making “false and misleading” assertions about its sale.

On November 13, Naeem Azad and Mihai Caluseru filed a case in a federal court in California, alleging that Caitlyn Jenner and her manager Sophia Hutchins had broken both federal and state securities laws by advertising the meme coin JENNER. This information was reported by Bloomberg Law.

They assert that they would not have purchased the JENNER token in the first place if it weren’t for Jenner’s “false and misleading statements and omissions,” and that they lost over $56,000 as a result of purchasing the token on EthereumEthereum eth 1.84% Ethereum and Solana (SOL).

The JENNER coin was initially introduced on Solana via the pump.fun at the beginning of May 2024. But soon after, Jenner said that a middleman called Sahil Arora had “scammed” her.

Jenner’s account was purportedly socially engineered to promote a fraudulent currency named JENNER, which had a sharp decline in value soon after its creation, as previously reported by crypto.news. Sahil was hired by the former gold medallist and her team to create the cryptocurrency, but they said he deceived investors by selling all of the token holdings after the launch.

Azad and Mihai said that shortly after Jenner severed her relationship with Sahil, she had first assured investors that she would not reissue the token, preferring to continue promoting the original.

According to the complaint, Jenner assured the investor that there would be no relaunch and that she and her team would encourage the growth of this token on the Solana blockchain.

The JENNER token, which Jenner later relaunched on Ethereum, reportedly leveled the value of the original Solana token and attached a 3% “tax rate” to each transaction—something the star, according to Azad and Caluseru, never fully revealed.

The JENNER coin, which was first introduced on Ethereum, reached a new all-time low on November 13 at $0.00007623, according to data from CoinGecko. The market value of the celebrity meme coin has increased to $170,429 from its previous peak of around $7.5 million.

In addition, the complaint claimed that Jenner’s failure to register the token with the Securities and Exchange Commission caused “significant damages” for purchasers who were unable to assess the token’s risk.