While the Republicans confer on crypto policy, the Senate intends to pass a Bitcoin reserve law within the first 100 days of Trump’s administration.

Senator Cynthia Lummis of the United States expressed hope that plans to establish a strategic Bitcoin (BTC) reserve will be put into action shortly after Donald Trump takes office.

“If we have the public’s backing, I think we can complete this within the first 100 days with bipartisan support. It is revolutionary for our country’s solvency. Let’s approve the Bitcoin Act and place America on a stable financial foundation.

Cynthia Lummis, a senator

David Bailey, the CEO of BTC Inc., who has been actively advising Trump on bitcoin legislation, was addressed in Lummis’ piece. In the past, Bailey has indicated that the incoming government might swiftly establish such a reserve.

“The policy wishlist of the Bitcoin and cryptocurrency sector is extensive and urgent. However, the most important and revolutionary initiative on President Trump’s agenda is the Strategic Bitcoin Reserve. Everything is altered by the downstream repercussions. We have one hundred days to finish it.

David Bailey, CEO of Bitcoin Inc.

Bailey also suggested expanding the use of Bitcoin in government initiatives. There would be a debate over paying 5–10% of Social Security benefits in Bitcoin, kept in a strategic reserve, he said, if Robert F. Kennedy Jr. were nominated Secretary of Health and Human Services and took over the administration of the program.

Regarding the Bitcoin reserve initiative, what is known?

In July 2024, Trump made the announcement during a rally for his election campaign that a Bitcoin reserve will be established in the United States. According to media sources, Senator Cynthia Lummis was working on the BITCOIN Act of 2024, a Bitcoin reserve law, a few days before to the politician’s declaration.

In order to safely keep Bitcoin reserves, the legislation suggests building a countrywide network of decentralized vaults. Over a five-year period, the U.S. Treasury Department is expected to hold 200,000 Bitcoin, and the country’s reserves will finally reach one million Bitcoin. Additionally, it is anticipated that Bitcoin reserves would be held for a minimum of 20 years.

The acquisition of the cryptocurrency may come at the price of other resources available to the government, such as gold certificates. Lummis suggests revaluing cryptocurrencies in order to pay for its acquisition.

The proposal also intends to create a reserve verification mechanism to confirm the money’s availability and combine all of the Bitcoin that is now in the U.S. government’s control into a single reserve.

The U.S. will become a new crypto sanctuary with its Bitcoin reserves.

Implementing the proposal to establish strategic reserves in Bitcoin has the potential to significantly increase institutional and governmental interest in the cryptocurrency, according to analysts at CoinShares. Their predictions indicate that this might hasten its rise and propel its worth to unprecedented levels.

Many members of the bitcoin industry generally anticipate that the U.S. wager on Bitcoin will greatly boost the cryptocurrency’s appeal as an investment. Pomp Investments founder Anthony Pompliano, for instance, is certain that the campaign would make the market feel FOMO.

According to Lummis’ proposal, the rate of Bitcoin purchases can surpass the price of mining BTC. A cryptocurrency deficit will develop in the market as a result, which may also help to sustain the rate of increase.

The Trump rally is underway. Or only a rally?

Lummis’ statements are generally supported by the state of Bitcoin and the cryptocurrency industry as a whole since the US elections. Bitcoin has reached its historical highs several times in the last week.

In only one week, the whole cryptocurrency market’s capitalization increased by 25% to surpass $3 trillion. At the same time, the price of Bitcoin has risen by 23.8% in just 7 days, hitting $93,000 and repeatedly surpassing the all-time high.

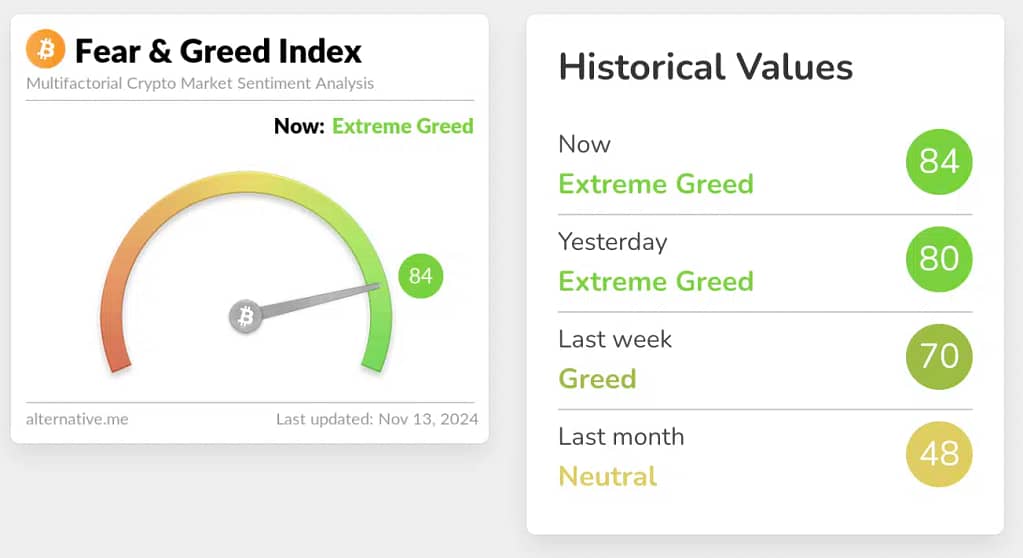

The tremendous greed of the cryptocurrency market is demonstrated by the fact that its index of fear and greed has increased by as much as 14 points in a single week, from 70 to 84 out of 100.

Nonetheless, other analysts questioned if Trump’s win was the sole factor propelling the cryptocurrency market’s expansion.

As a result, following the April Bitcoin halving, Jesse Myers, co-founder of Onramp Bitcoin, observed that such crypto market fluctuations are normal and predictable. The market has seen a scarcity of coins throughout this period, therefore demand is driving up the price. This sets off a series of events that ought to result in the formation of another bubble.

It seems reasonable to anticipate a similar scenario this time around, since Myers pointed out that the same thing occurred following each of the previous Bitcoin halvings. It was simply a spark when the U.S. government changed to one that would be more receptive to cryptocurrency.