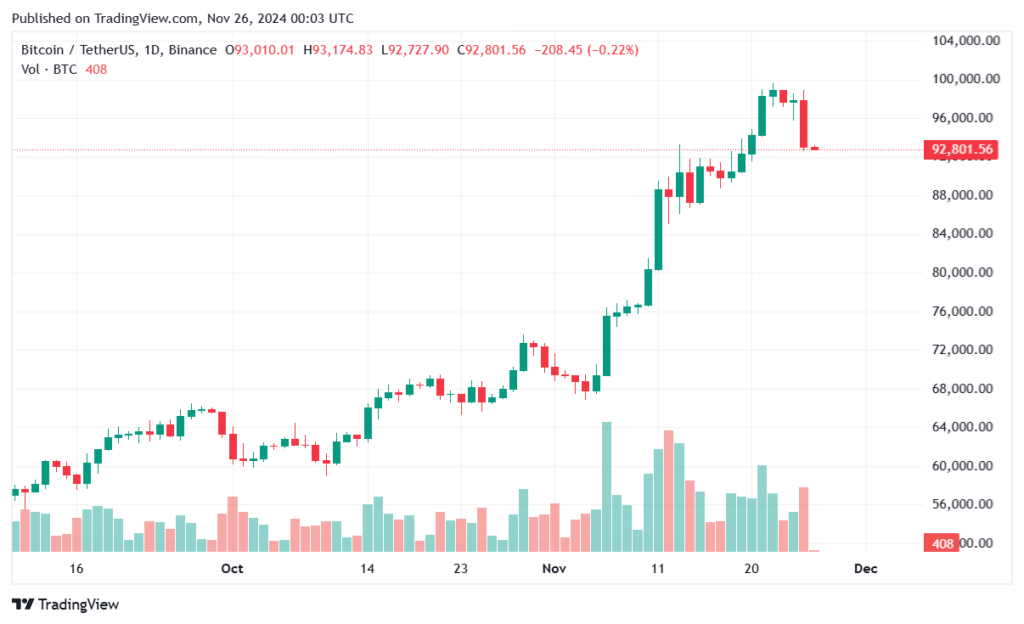

Merchants have witnessed a large half-billion greenback quantity of crypto liquidations in a day after Bitcoin dropped to its lowest worth the previous week.

In accordance with Coinglass’s knowledge on Nov. 25, crypto merchants have seen large liquidation of about $553 million within the past day of buying and selling. Merchants with lengthy positions have liquidated $413 million as Bitcoin’s worth dropped to $92k, lowering virtually 5% in a day.

The lengthy positions within the final 12 hours and 4 hours have seen main crypto liquidation with $344 million and $140 million, respectively. The brief positions previously day additionally raised into triple digits, $138 million.

Bitcoin (BTC) and Ethereum (ETH) are probably the most important contributors to crypto liquidation. At the time of writing, Bitcoin recorded $24 in each position, whereas Ethereum recorded $11 within the lengthy position and $3 million within the brief one.

Round 169,879 crypto merchants have liquidated the previous day, and merchants from the Binance change are probably the most important variety of liquidations with $4.67 million in BTC/USDT pair.

The crypto market capitalization in quantity additionally dropped virtually 3% to $3.23 trillion, and the buying and selling quantity is around $240 billion.

Crypto liquidations proceed

Small market capitalizations of altcoins have seen a big impression because of the crypto liquidations; around $100 million have been misplaced available in the market. A complete of $494 million was liquidated on Nov. 24.

This market-wide correction is taken into account by regular circumstances after the Bitcoin rally the previous month. Primarily based on CoinMarketCap knowledge at the moment, Bitcoin nonetheless dominates the market at 57.4%, and the crypto fear-greed index confirmed 82 factors, which signifies the market is in an extremely grasping place.

This wave momentum additionally doubtlessly triggered additional bullish as macro-economy circumstances, particularly in the US, are promising the way forward for crypto. It could additionally convey a constructive sentiment in the direction of the market after Bitcoin’s dominance dropped andth pression the altcoins ralrallied…………………………

AI GLOBAL NEWS, Sourcing NEWS from >>> CRYPTO NEWS

Subscribe for updates!