DYDX, the native token of the decentralized buying and selling platform dYdX, recorded a formidable rally on Nov. 6 following studies of it being backed by Trump’s newly appointed White House cryptocurrency advisor.

The altcoin surged 35% over the previous day, hitting a seven-month excessive of $2.45 on Nov. 6, bringing its market cap to over $1.67 billion. The current rally positioned DYDX as the main gainer among the many high 100 cryptocurrencies by market cap, rating 94th in response to knowledge from CoinGecko at press time.

Dydx‘s value surge additionally prolonged its fortnightly good points to over 83%, while boosting its month-to-month good points to greater than 125%. Every day buying and selling quantity for the token jumped 113.9% over the day past to over $369 million.

Why did DYDX value soar at this time?

DYDX’s current rally was primarily pushed by studies that President-elect Donald Trump appointed David O. Sacks as the White House Director of Synthetic Intelligence and Cryptocurrency.

The information gained traction as Sacks’ enterprise capital agency, Craft Ventures, has made big funding in DYDX. This connection between the newly appointed crypto czar and the token fueled sturdy bullish sentiment amongst its buyers, propelling DYDX to current good points.

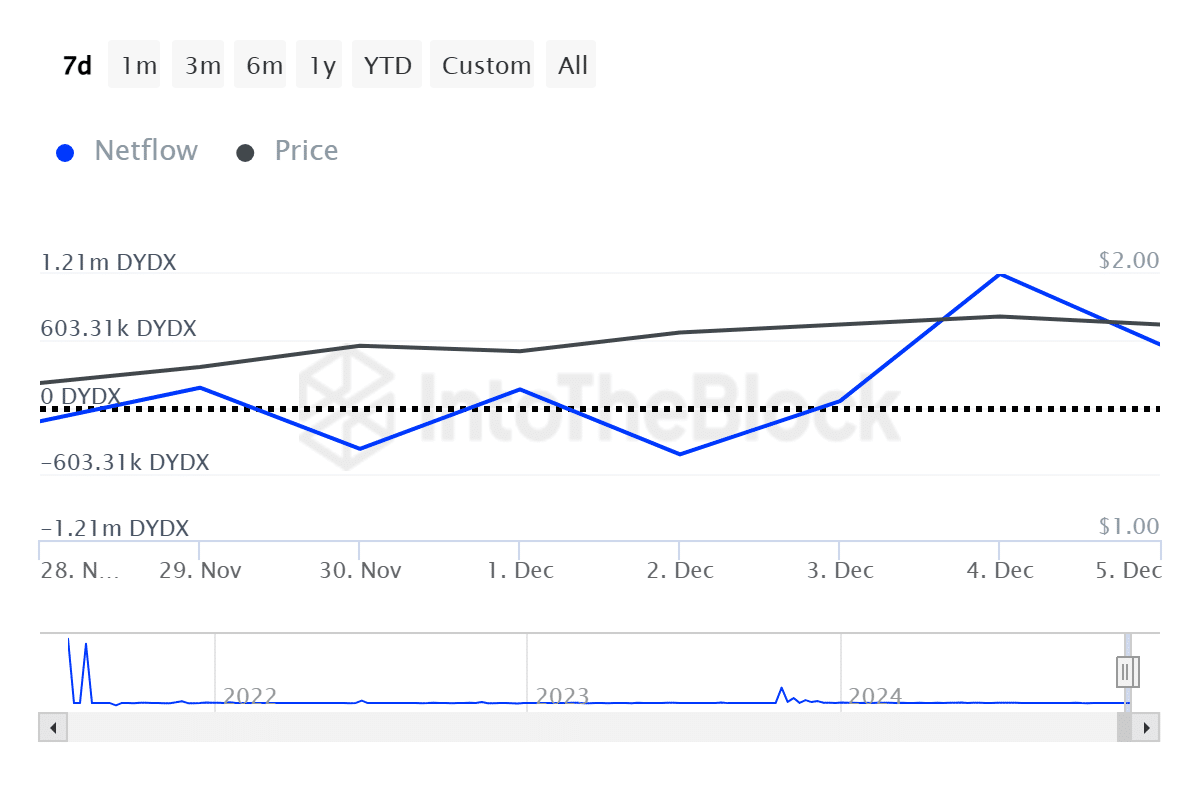

One other catalyst possibly contributing to the altcoin’s rally is the rising demand noticed amongst whale buyers. In keeping with knowledge from IntoTheBlock, DYDX whale holder web flows shifted from a web outflow of $766K worth of DYDX tokens noticed on Dec. 2 to a web influx of over $2.2 billion worth of DYDX tokens on Wednesday, Dec. 4.

When whales start accumulating, it usually sparks FOMO amongst retail buyers, who then pile into the altcoin, searching for potential income.

Additionally, in response to DeFiLlama knowledge, the DeFi protocol’s whole worth locked has additionally surged from round $226 million in November to over $445 million at press time.

Rallies influenced by political developments are usually not unusual within the crypto house. Beforehand, Reserve Rights’ native token, RSR, surged over 130% in a single day following studies that Trump had approached former SEC Commissioner Paul Atkins, a former advisor to the Reserve Rights Basis, to succeed Gary Gensler as the subsequent SEC Chair.

………………………….

Sourcing information and pictures from crypto.information

Subscribe for updates!