Ethereum noticed an upswing, breaking via the $3,400 mark because the markets reacted to political waves main towards a presidential inauguration.

After struggling for every week, from Jan. 11 to 17, Ethereum (ETH) broke the downward motion, pushed previous its final resistance degree of $3,400 and is at the moment buying and selling at $3,406.72 on the time of writing.

This market optimism is pushed by speculations that President-elect Donald Trump would signal an govt order associated to cryptocurrency when he takes workplace on Jan. 20.

Discussions are additionally underway for this order to incorporate a directive for all federal businesses to overview their crypto insurance policies along with the potential for suspending ongoing litigation in opposition to trade giants.

With a management change anticipated, the SEC determined to settle with Abra yesterday over unregistered crypto lending merchandise. This has set a optimistic movement for the whole crypto market, which noticed a 3.54% uptick within the final 24 hours, as per CoinMarketCap.

Trump’s crypto-friendly stance is additional strengthened with the information that pro-crypto Congressman Tom Emmer was elected Vice Chair of the Digital Belongings Subcommittee on Jan. 15.

One other element which has led to ETH’s rise is the announcement of ETH’s upcoming Pectra Improve’s launch within the Execution Layer Assembly 203. The Pectra improve is eagerly awaited as an answer to a few of Ethereum’s most difficult points.

Through the years, Ethereum has confronted congestion and raised gasoline charges. The Pectra improve goals to improve the consensus layer and improve transaction velocity and effectivity whereas additionally establishing the groundwork for seamless interoperability between the Layer 2 options and the mainnet, which is very essential for the way forward for blockchain enlargement.

Ethereum’s worth may rise additional

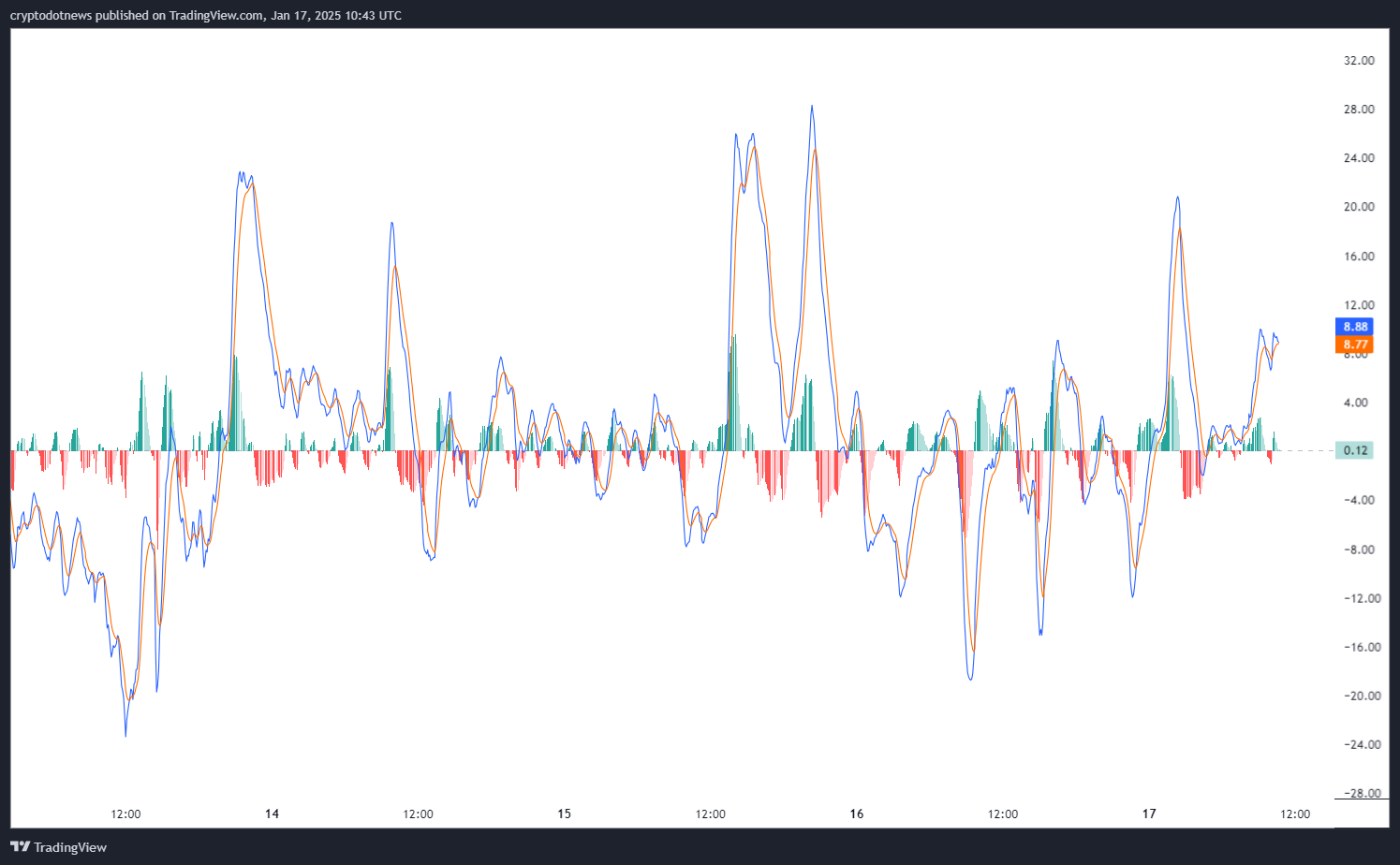

In line with the Shifting Common Convergence Divergence (MACD) chart, ETH is offering purchase indicators, that means that, at the least for the close to time period, some upward momentum could be anticipated in worth will increase.

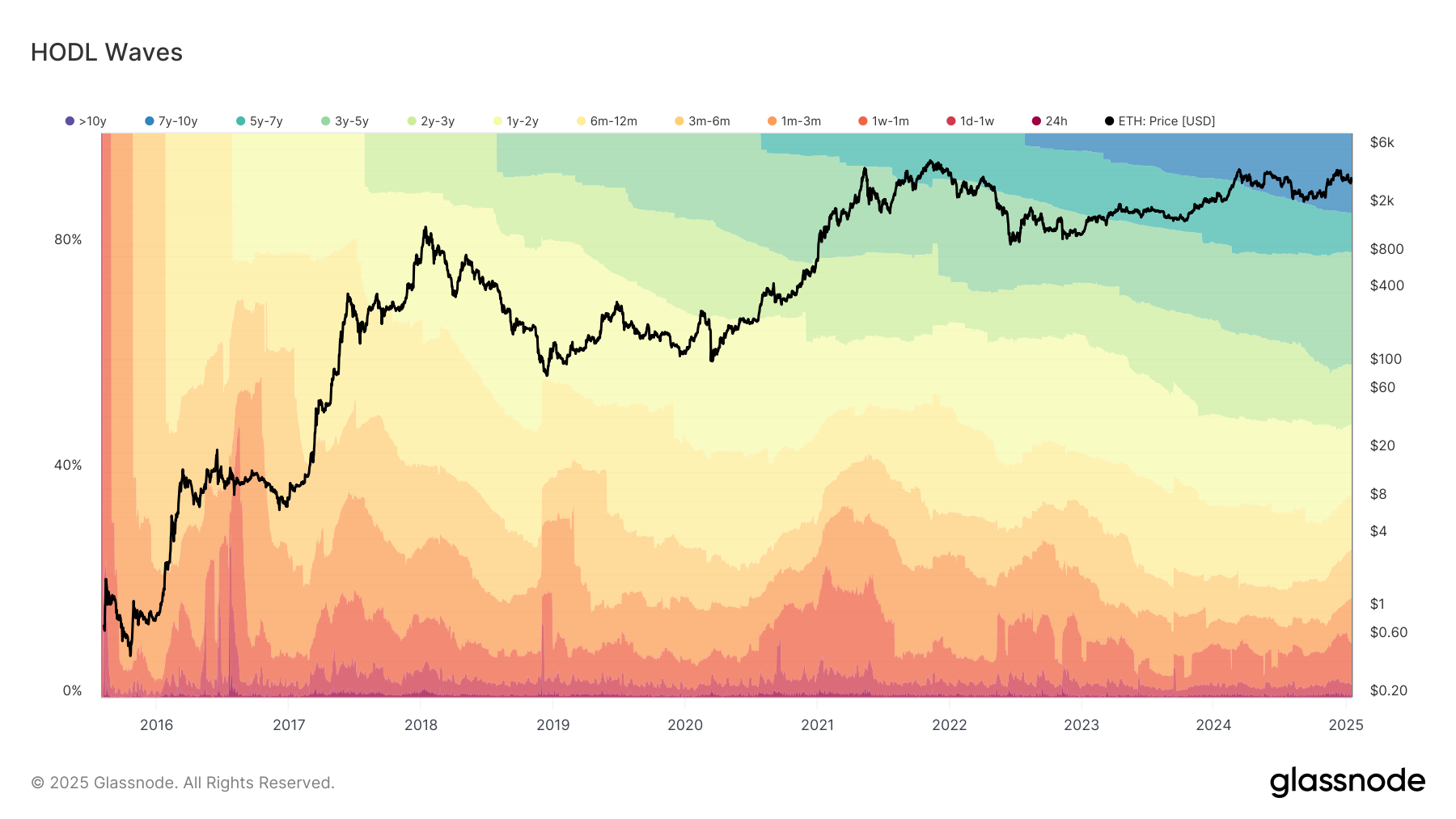

The MACD measures adjustments in momentum, indicating probably worth tendencies, whereas HODL Waves replicate long-term holding conduct. Mixed, they provide an perception into future worth actions.

The holding wave, HODL, expresses sturdy long-term holding sentiment with a considerable provide of ETH being held for greater than twelve months, displaying lasting investor confidence and lessened short-term promoting stress. These nice occasions level out that ETH is a possible candidate for a possible worth uptick. Nevertheless, ETH costs may need minor fluctuations because the market digests these developments.

………………………….

Sourcing information and pictures from crypto.information

Subscribe for updates!