Ethereum’s worth has dropped sharply this yr after encountering substantial resistance on the $4,000 stage in December.

Ethereum (ETH) has declined by almost 20% from its December excessive, coinciding with an ongoing sell-off in Bitcoin and different altcoins.

The downturn has been partly attributed to outflows from Ethereum spot exchange-traded funds. On Wednesday, these funds noticed internet outflows of $159 million, following $86 million yesterday. Nevertheless, regardless of current outflows, Ethereum ETFs have attracted a internet influx of $2.5 billion since their approval in 2024.

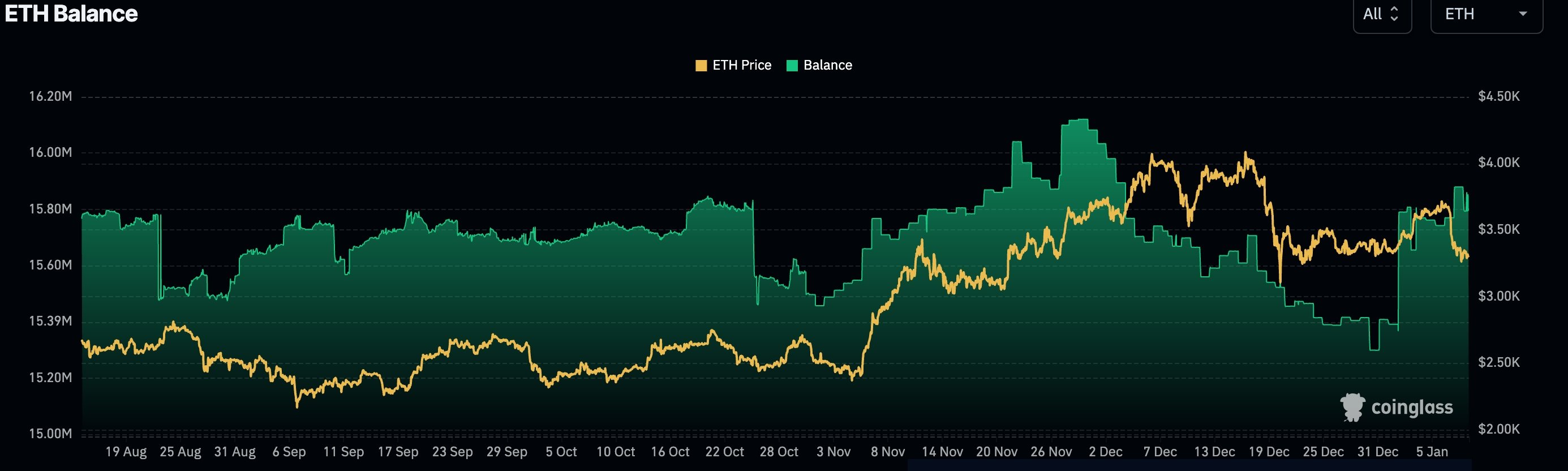

ETH’s decline has additionally coincided with an increase in trade balances. In line with CoinGlass, the variety of ETH held on exchanges rose to fifteen.85 million on January 9, up from 15.3 million on December 30. A rise in trade balances typically signifies that buyers are liquidating their holdings.

From a macroeconomic perspective, ETH has been impacted by surging U.S. bond yields amid a hawkish Federal Reserve stance. The 30-year bond yield climbed to 4.96%, its highest stage since October 2023. Quick- and medium-term bond yields have additionally continued to rise.

Rising yields recommend that the market expects the Fed to take care of its hawkish strategy resulting from persistent inflation issues.

Ethereum worth evaluation

The weekly chart reveals that ETH encountered important resistance on the $4,000 stage, which it has struggled to surpass since March of final yr.

Regardless of the current pullback, the cryptocurrency stays above the 50-week and 100-week shifting averages, indicating that bulls nonetheless preserve some management.

Most notably, Ethereum is regularly forming an inverse head and shoulders sample, a well known bullish reversal sign. The “head” is at $2,155, whereas the “left shoulder” shaped at $2,825. So long as ETH stays above the shoulders at $2,825, the bullish outlook stays intact.

A confirmed breakout would happen if ETH strikes above the neckline at $4,085. If this occurs, the subsequent ranges to observe are the all-time excessive of $4,865 and the psychological milestone of $5,000. Nevertheless, a drop under the proper shoulder at $2,825 would invalidate the bullish view.

………………………….

Sourcing information and pictures from crypto.information

Subscribe for updates!