A worldwide assume tank proposed Amazon to incorporate Bitcoin into its strategic reserve by subsequent years. This proposal is identical to Microsoft’s proposed by Michael Taylor a number of weeks ago.

The Nationwide Heart for Public Coverage Analysis, an impartial world conservative assume tank primarily based in Washington, D.C., has proposed the Bitcoin (BTC) strategic reserve to the fifth world’s largest firm, Amazon.

This proposal goals to bid the money and money equal of the corporate, which accounts for $88 billion that features the U.S. authorities, company, and international bonds, to contemplate including Bitcoin to its strategic reserve by the following annual assembly in April 2025.

“Amazon ought to—and maybe has a fiduciary obligation to—take into account including asset to its treasury that approximate greater than bonds, even when these asset are extra unstable short-term.”

Primarily based on the document that was shared by Tim Kotzman X’s submit on Dec. 09

The U.S. inflation fee reached a peak of 9.1% in June 2022, which is the principle reason why the corporation ought to undertake Bitcoin as the opposite firm did. As their bond charges additionally didn’t exceed the actual inflation, it’s not ample to guard billions of {dollars} of shareholders by holding this property.

Nationwide Heart is additionally famous that Bitcoin’s efficiency prior to now has risen to 131%, surpassing the bonds by 126%. It additionally outperforms the company bonds by 1.246% in a single year.

MicroStrategy for example for Amazon

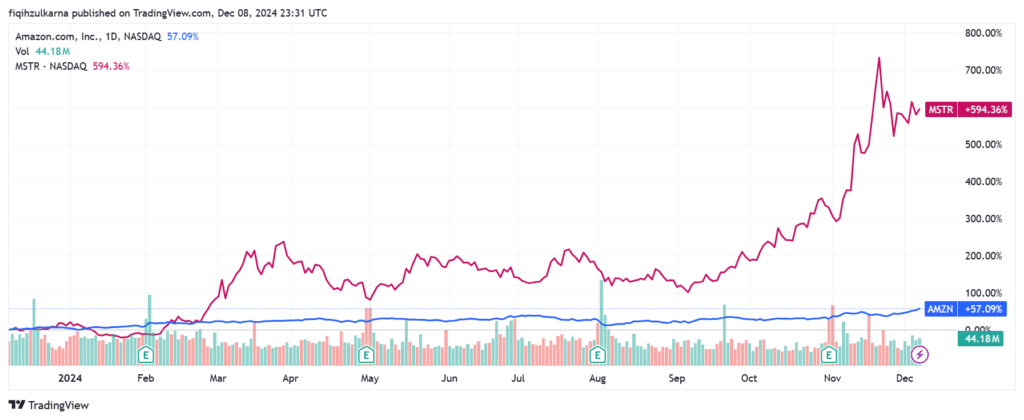

MicroStrategy began the transfer by including Bitcoin as their monetary asset in 2020, and now the inventory efficiency has risen by 594%, outperforming Amazon (AMZN) inventory, which solely elevated 57% in a year.

A couple of weeks in the past, MicroStrategy government chairman Michael Saylor additionally introduced the Bitcoin reserve for Microsoft; the corporate will determine it inside this week.

Additionally, they talked about how Saylor’s motion is adopted by many corporations and establishments, together with BlackRock and Constancy, that are releasing Bitcoin’s ETF to the inventory market earlier this year.

In conclusion, the Nationwide Heart has suggested Amazon diversify its steadiness sheet by including at the very least 5% of its property into Bitcoin. It’s not solely a part of the transfer that technological corporations have to make; however, they need to protect their assets and the worth of the shareholders with the unbeaten inflation of digital property.

………………………….

Sourcing information and pictures from crypto.information

Subscribe for updates!