Ripple confirmed that it has delayed the launch of its stablecoin. In the meantime, the value of XRP has dropped, causing it to lose its recently earned place as the third-largest cryptocurrency.

Ripple, extensively recognized for its cross-border funds within the crypto area, has postponed the launch of its stablecoin, $RLUSD, because it awaits a closing nod from the New York Division of Monetary Companies. In an official announcement on X, Ripple mentioned, “$RLUSD isn’t launching at present.” on Dec. 5.

The announcement coincided with a noticeable decline in Ripple’s native token’s (XRP) market value. XRP’s value dropped from $2.59 to $2.31 within 24 hours, as per CoinMarketCap. This sharp tail-off has pushed XRP away from the place of the third largest cryptocurrency by market capitalization, falling in need of Tether’s (USDT) market cap of $135.8 billion.

XRP’s promoting strain will increase

At press time, XRP’s market cap stands at $131.42B, a 12% drop seen within the final 24 hours. Nonetheless, XRP continues to remain ahead of Solana (SOL) and Binance token (BNB) even because the latter reached its all-time excessive on Dec. 4. XRP’s 24-hour buying and selling quantity additionally plummeted to $26.02 billion, practically 40% down from yesterday.

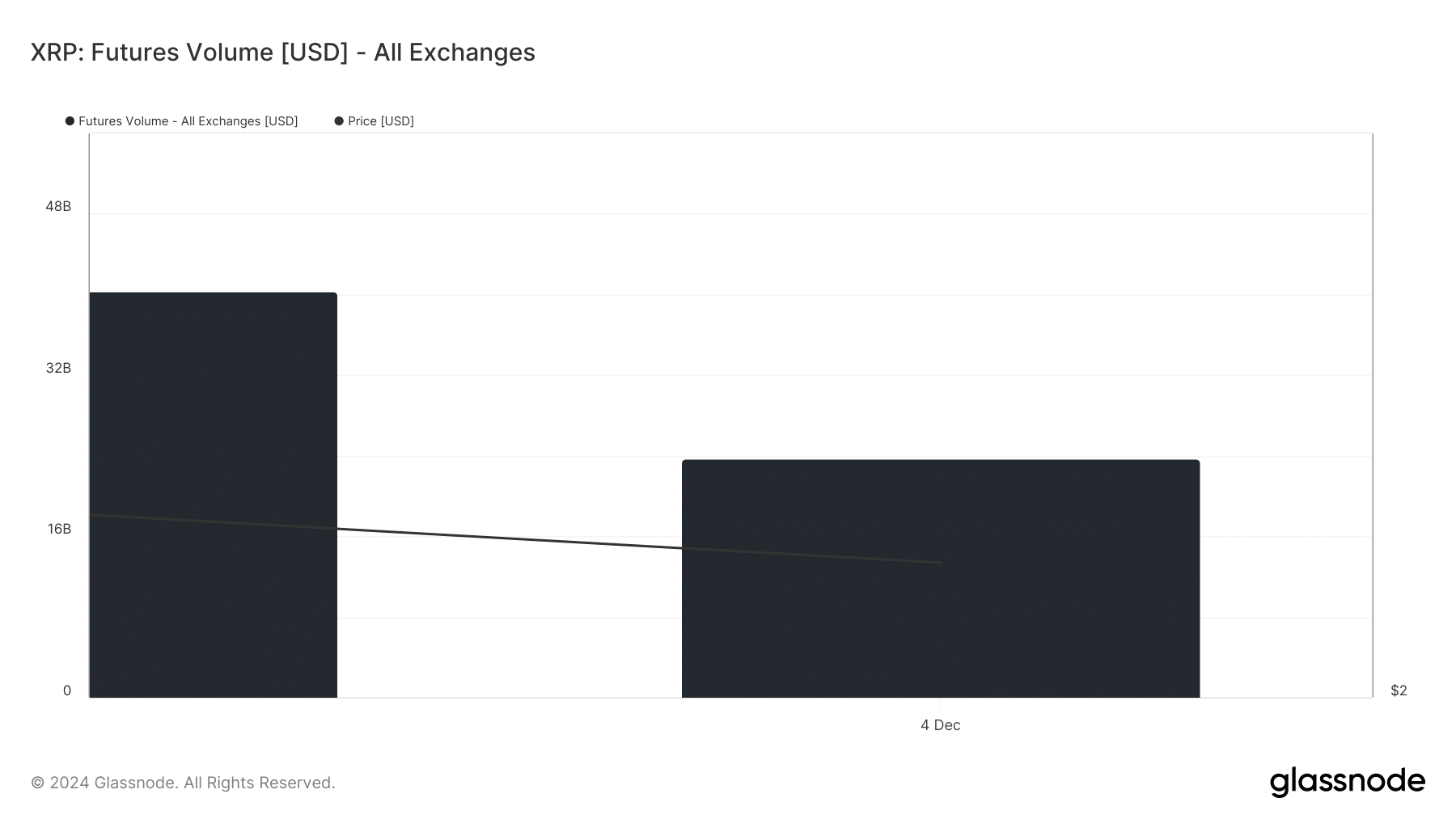

Whereas the information of the postponement of RLUSD preceded the drop in value, speculations might be tied to the panic promotion, as per Glassnode metrics. That is additional highlighted within the elevated promoting strain, the place each value and buying and selling quantity has come down over $32 billion to $16 billion on Dec. 4, confirming that the market is in a cooling-off interval in the mean time. This might even have added to XRP’s rating and its drop from the third-largest crypto.

What’s subsequent for XRP?

The worth may be influenced by the surge in stablecoins the market is witnessing, mirrored by the 24-hour quantity at $317.13 billion. Ripple’s success with its stablecoin is essential to enhancing its On-Demand Liquidity platform, which facilitates swift cross-border funds and will drive XRP costs to increase.

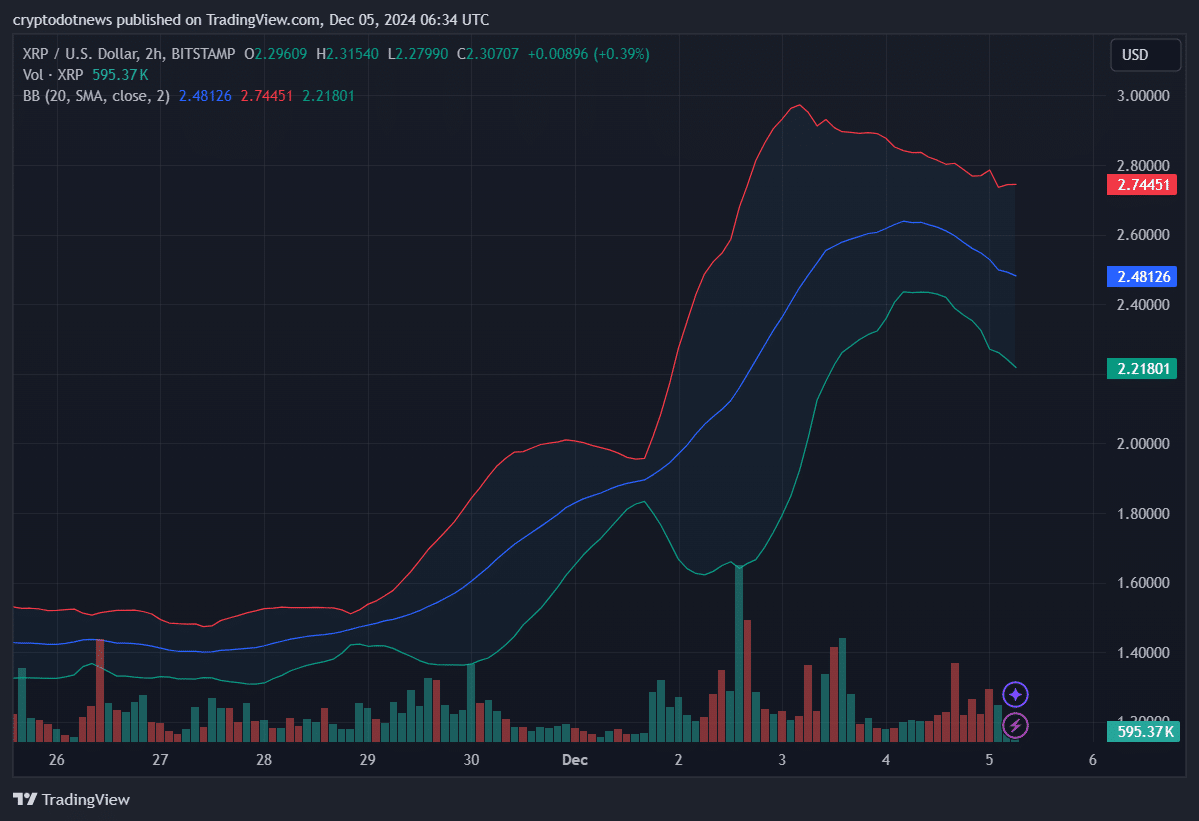

As a measure of XRP’s current value motion, Bollinger Bands can present the place the value is and the place it is likely to be headed subsequent.

After rising sharply as much as its most up-to-date resistance at $2.74451, the help low was simply above the essential $2.21 stage. At current, the narrowing of the bands implies diminished volatility, with market contributors in search of both a breakout or breakdown to determine the subsequent main XRP value transfer.

Disclosure: This text doesn’t symbolize funding recommendations. The content material and supplies featured on this web page are for academic functions solely.

………………………….

Sourcing information and pictures from crypto.information

Subscribe for updates!